by Jared Levy on July 1, 2010

When you think of stocks, you probably think of buy, sell, or hold when it comes to your investing choices.

When you think of stocks, you probably think of buy, sell, or hold when it comes to your investing choices.

When you take a position in a stock, it must move in your desired direction for you to be profitable.

Depending on your opinion toward a particular company, you are really limited as a stock trader to more of a full “on or off” sort of sentiment. Of course, you can choose to only allocate a certain percentage of your account to the trade (to manage your risk) or you can even diversify your portfolio to mitigate volatility and/or create a partial hedge in your account.

Here’s a diversification example:

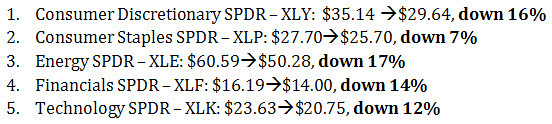

The fact of the matter is that if you were to have bought ETFs in five different S&P 500 sectors in late April (April 28, to be specific), you would most likely have net losses in every one of your positions. Below you will see the price changes from April 28 through June 29, 2010 in these popular sector ETFs:

If you had allocated 20% of your account evenly into these 5 sectors, you would have a net loss of 13.2% over that time period. Individual stocks may have done better or worse, but ETFs may also in and of themselves offer another level of risk reduction through diversity.

By diversifying, this particular strategy helped to moderate the major losing trades, but also worsened the better…