Not everyone in the food service business is thriving. Higher input costs and a cautious consumer with less income on average have been thinning out the hungry herds at some restaurants. One unique company that stands out in the space is Cracker Barrel.

Cracker Barrel (CBRL) offers an affordable and tasty eat-in option for locals (622 company-owned locations in 42 states) and a strong mail order business that sells everything from food to furniture and even music. Heck they even produce and sell special edition CDs that feature acts like Brad Paisley and LL Cool J (how’s that for diversity).

Their average restaurant check amount has been steadily increasing roughly 2.6% annually over the last 5 years (we have seen similar, but more pronounced strength in earnings in that time frame as well). Another fact I found interesting was that they have a fairly even split between breakfast, lunch and dinner traffic which keeps their restaurants and stores (mostly positioned just off major interstates) in a state of constant activity and operation.

Biglari refuses buyout

Perhaps the bigger (or at least more interesting) story is not the stock’s earnings momentum, but the recent maneuvers by Sardar Biglari of Biglari Holdings (BH) who now owns $355+ million worth (19.99% stake) of Cracker Barrel. Mr Biglari has been trying to shake things up a bit at the company and has failed to gain the control he wants.

Just recently, Cracker Barrel Chairman James W. Bradford Jr. offered to buy back Biglari Holdings’ shares at market price, which would allow Biglari to make roughly $70 million appreciation on his stake, but he refused. Biglari owns Steak and Shake, a competitor and has tried (and failed) to gain seats on the board of CBRL over the last 3 years through proxy battles.

It seems Mr. Biglari sees upside in CBRL regardless of his diversions, which adds value to the stock here in my opinion.

Do earnings justify the rally?

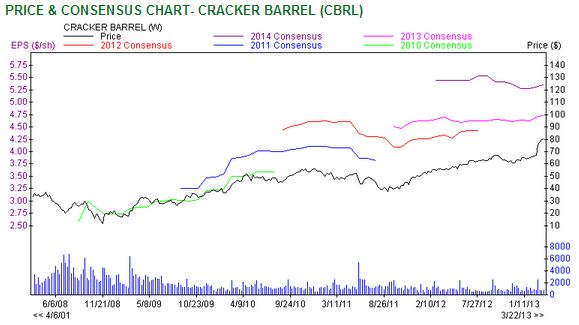

In the most recent quarter, Cracker Barrel posted a 0.2% increase in comparable store traffic, with a 3.3% increase in same-restaurant sales. This marked the fifth consecutive quarter of increased traffic and sales. On an adjusted basis, operating income margin grew by nearly one point, to 8.4%. Adjusted EPS for the quarter came in at $1.43, versus $1.20 in the year-ago quarter. Revenue grew nearly 4.5% to nearly $702.7 million.

Their guidance was a bit on the conservative side, with expectations in the $4.60 to $4.80 range compared with 2012 full year EPS of $4.61. The Zacks consensus estimates are closer to the high end at $4.73 per share. In 2013 the company is expected to open 9- 11 new restaurants and stores.

Earnings momentum has been strong despite some doubts surrounding return on capital, the stock has delivered earnings growth and analyst continue to up their estimates in the company. Cracker Barrel reports on May 21st and has a positive ESP of 1.08% for the current quarter.

Shares currently trade at 16 times forward earnings, which is actually low for the space.

A good value?

I certainly wouldn’t use the word “value” to describe shares of CBRL, but looking at the majority of their peers, relative value is certainly appropriate. Shares have appreciated 20% in the last month alone, which is something to take into consideration, but that rise may be justified.

Soft commodity prices should remain somewhat stable and barring another major drought, shouldn’t rise back to their peaks of last year. Cracker Barrel has already secured 45% of their commodity related needs as of Sept. 19, 2012.

The company expects comparable store restaurant and retail sales to increase anywhere from 2% to 3% in 2013. This includes menu price increases of about 2% and accounts for commodity inflation of 5.0% to 6.0%

That should equate to total revenue between $2.6 and $2.65 billion according to their estimates and with analysts’ opinions looking bullish, I’d expect a strong year as well.

Cracker Barrel and Red Robin are the only Zacks Rank #1 stocks in the space; Red Robin (RRGB) was recently upgraded as well, but trades at 21 times forward earnings. Other competitors like Bloomin Brands (BLMN), Burger King (BKW), Jack in the Box (JACK) and others have lower Zacks Ranks and higher multiples.

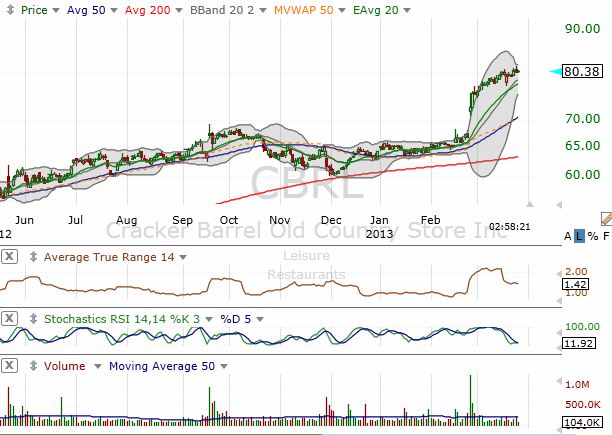

The Charts

Cracker Barrel has maintained relatively stable stock growth over the last two years. It hasn’t been below its 200 day moving average in that time and has recently gained momentum after reporting strong results.

Look for some support around the 20 day moving average of $77.45, with substantial technical support around the $70.86 area which is where the lows of the earnings gap coincide with the 50 day moving average and VWAP.

Shares are currently forming a sideways to moderately bullish channel and are near the top of their recent range. Resistance will be minimal at the 52 week high of $81.42.

All in all it’s a good dividend stock (yields 2.6% annually) with strong earnings momentum and a favorable Zacks Rank.

Jared A Levy is one of the most highly sought after traders in the world and a former member of three major stock exchanges. That is why you will frequently see him appear on Fox Business, CNBC and Bloomberg providing his timely insights to other investors. He has written and published two tomes, “Your Options Handbook” and “The Bloomberg Visual Guide to Options”. You can discover more of his insights and recommendations through his two portfolio recommendation services:

Zacks Whisper Trader– Learn to buy stocks likely to have robust earnings BEFORE they report.

Zacks TAZR Trader – Technical Analysis + Zacks Rank. Best of both worlds approach to find timely trades.

Follow Jared A Levy on twitter at @jaredalevy

Like Jared A Levy on Facebook