WSO FIX

The increasing population and global distribution of wealth through increased trade and e-commerce is helping to fuel both the residential and commercial housing markets as well as construction and expansion of industrial and commercial structures of all times, not to mention the companies that maintain those buildings.

Today’s Bull of the Day is a unique stock that is a derivative play on the housing / economic recovery and the need for more creature comforts in the home and workplace (or at the very least basic heating and air conditioning).

No Place Like Home (and work)

Comfort Systems USA (FIX – Snapshot Report) is more than your local HVAC Company; they are a nationally integrated heating, ventilation and cooling (HVAC) business that offers solutions for homeowners as well as commercial applications. In fact, residential income is just a small part of their commerce.

Comfort Systems estimates that there are over 35,000 different companies that make up the highly fragmented HVAC field here in the U.S.. Their goal is to consolidate and economize this space and offer complete, quality solutions for consumers and local governments.

Essentially they have partnered with the best and brightest companies around the country and are continuously in the process of building a seamless network between them to better serve the public.

Past Results

The market of their customers are comprised of manufacturers/distributors (25%), healthcare (15%) and education (20%), with government and office buildings adding another 20% to their revenue.

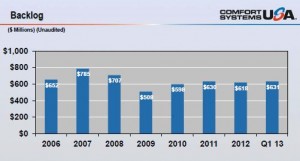

FIX’s revenues were actually down slightly versus the same quarter last year, but profits rose 20%. Shares are up roughly 40% in the last year.

Over the past five years, gross margin peaked at 20.0% and averaged 17.6%. Operating margin peaked at 6.0% and averaged 3.3%. Net margin peaked at 3.8% and averaged 1.2%.

- TTM gross margin is 16.3%, 130 basis points worse than the five-year average.

- TTM operating margin is 2.2%, 110 basis points worse than the five-year average.

- TTM net margin is 1.3%, 10 basis points better than the five-year average.

Shares currently trade at 27 times forward earnings and carry a PEG ratio of 4, which are both on the high side and no doubt carry more risk than your average S&P 500 stock. Comfort Systems also trades VERY light volume, which is another risk to consider before investing.

While this isn’t the best looking fundamental picture out there, I find their business model compelling enough to mention and I know that maintenance contracts on aging HVAC systems carry big margin, which could help FIX. All the new construction over the last decade placed many new systems on in service, and while FIX captured some of this, the bigger money will be in maintaining these systems that are coming up in age.

Companies that are needing to stabilize costs in this weak economic recovery may opt for HVAC contracts to maintain their systems, adding to revs for FIX.

Earnings Heating Up?

With record high temperatures here in the U.S. and companies’ earnings stable, HVAC expenditures should be getting a boost.

To that end, there have been a good number of analysts that have moved their estimates higher over the last 60 days and just a couple that went down.

Earnings magnitude is moving in the right direction with estimates for current quarter as well as FY 2013 and FY2104 moving higher in that same time frame (Q3 estimates were flat to slightly down).

FIX has surprised analysts 3 of the last 4 earnings reports, exceeding analysts’ consensus expectations by an average of 214%.

While there is no doubt this is a higher risk stock, it’s worth exploring deeper for opportunity. Use caution with the low volume as even smaller trades can move the market.

If you are looking for something a little more stable in the HVAC space, check out Watsco Inc.(WSO – Analyst Report) (Zacks Rank #2), they are one of the largest distributors of air conditioning and heating equipment and related parts and supplies in the United States. The company also sells products used in the refrigeration industry. Such products include condensing units, compressors, evaporators, valves, walk-in coolers and ice machines for industrial and commercial applications.

Jared A Levy is one of the most highly sought after traders in the world and a former member of three major stock exchanges. That is why you will frequently see him appear on Fox Business, CNBC and Bloomberg providing his timely insights to other investors. He has written and published two tomes, “Your Options Handbook” and “The Bloomberg Visual Guide to Options”. You can discover more of his insights and recommendations through his two portfolio recommendation services:

Zacks Whisper Trader– Learn to buy stocks likely to have robust earnings BEFORE they report.

Zacks TAZR Trader – Technical Analysis + Zacks Rank. Best of both worlds approach to find timely trades.

Follow Jared A Levy on twitter at @jaredalevy

Like Jared A Levy on Facebook