Remember the “original white meat?” Yes, chicken and more specifically a Zacks Rank #1 stock called Sanderson Farms ( SAFM – Snapshot Report ) might be worth a look as part of your portfolio smorgasbord.

Aside from my love for the meat itself, chicken and the companies that produce them have been on my radar for some time. In 2011 I did quite a bit of research into the chicken industry titans such as Tyson, Pilgrim’s Pride and today’s bull, Sanderson Farms. I have mentioned Sanderson as a favorite on Fox Business several times, including this appearance just ahead of the New Year (chicken comments start around 3:30).

Chicken producers including Sanderson went on a tear from late 2011 into mid 2012 and then took at bit of a beating late last year due to skyrocketing feed costs, plummeting chicken prices and reduced consumption.

Sanderson has resumed its bullish run over the last 6 months and despite the fact that shares are up nearly 40% since late December, Sanderson continues to prove why it still should be part of your portfolio.

Food Inc

Companies like Tyson Foods TSN, Hormel ( HRL – Analyst Report ) , Sanderson Farmsand Pilgrim’s Pride PPC, to name a few, actually grow or raise their own crops and livestock in addition to preparing and packaging and finally selling to distributors like Wal-Mart ( WMT – Analyst Report ) , Kroger ( KR – Analyst Report ) , Safeway ( SWY – Analyst Report ) and other stores for our dining pleasure.

They produce immense quantities of food for a growing population that is demanding more and more proteins like chicken. To achieve their more than 2 billion pounds of annual product shipments, Sanderson employs over 10,000 people, 700 independent growers and ships to nearly every state in the U.S. as well as many developed foreign nations.

They also have tight controls and automation when it comes to their hatcheries, feed mills, processing and distribution in an effort to maintain consistency and their products’ “natural” classification.

Chickens are big business; there are more chickens in the world than any other domesticated bird and more chickens in the world than there are people.

To keep up with demand, Sanderson’s most recent facility addition is a “big-bird” deboning facility in Waco, Texas that will process approximately 1,250,000 birds per week; obviously not a “fly by night” operation…

Earnings Comeback

2011 was a fairly tough year as earnings expectations tumbled for SAFM. FY2012 and FY2013 estimates also dipped in mid 2012 with the sharp rise in commodity prices (feed) and a global economy mostly in recession, forcing chicken prices lower.

Sanderson dealt with low demand in 2012 by economizing their business and improving margins.

At their last report, Sanderson actually reported a loss of 31 cents per share for the quarter, on revenue of $605.43 million for the quarter, compared to the consensus estimate of $559.30 million. The company’s revenue for the quarter was up 15.1% on a year-over-year basis.

Even though the company missed the Zacks consensus estimates for a 7 cent loss, the strong revenues and positive guidance carried the stock higher.

We’ve seen the majority of analysts increase their estimates for the chicken producer. Analysts at BMO Capital Markets raised their price target on shares of Sanderson Farms from $42.00 to $51.00 in a research note to investors on Thursday, April 11th. They now have a “market perform” rating on the stock.

Analysts at Sidoti and here at Zacks downgraded shares of Sanderson Farms because of its tremendous run recently and perhaps a slightly high valuation at 16 times forward earnings.

Current Zacks consensus estimates are for 72 cents in the current quarter, $1.59 for next quarter and $4.87 in FY2013, with expectations for an 8% increase in year over year sales.

Chickens and the Future

Sanderson and its peers are no doubt susceptible to commodity prices, chicken prices and chicken demand.

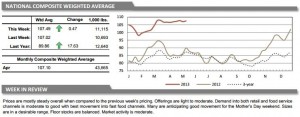

Late last year, we saw retail chicken prices hit all-time highs as producers continued to pass on the effects of this summer’s sky-high corn prices. According to the USDA’s retail broiler composite price, which measures the price paid for chicken parts and whole birds, chicken prices are not only much higher than last year (+17.63%), but stable and rising.

Mechanically separated chicken prices are also higher than last year and appear to be more stable at present.

On the grain front, we are seeing favorable conditions for corn planting and according to Peter Meyer of PIRA Energy Group, prices could go lower. “Besides weather, the key for the summer will be the conditions that the seed was planted in. For the most part they’ve been marginal at best. But, that all doesn’t matter with poor demand. It will take a sub-$4.50 price to really get demand heated up. But, I’m not so sure we can get there. We should be able to get down to $5.00 and then it’s a matter of consumers stepping up. If they don’t, it will lead to another leg lower” Meyer noted recently.

With high chicken prices, low input costs and increased consumer demand, the environment is almost what you would call a “chicken trifecta.”

Summary

There is no doubt that Sanderson’s success is dependent on several moving parts and that the stock has had a tremendous run, but if grain conditions are favorable and the U.S. and global economy stay stable at the very least, a 16 times valuation with a small 1.10% dividend is not a bad price to pay for a stock that is feeding the world’s growing desire for low-cost, healthy protein.

We will know more when the report earnings on May 21st; perhaps a “leg-in” strategy might be the best solution here, with a little long now and a little after the report.

Jared A Levy is one of the most highly sought after traders in the world and a former member of three major stock exchanges. That is why you will frequently see him appear on Fox Business, CNBC and Bloomberg providing his timely insights to other investors. He has written and published two tomes, “Your Options Handbook” and “The Bloomberg Visual Guide to Options”. You can discover more of his insights and recommendations through his two portfolio recommendation services:

Zacks Whisper Trader– Learn to buy stocks likely to have robust earnings BEFORE they report.

Zacks TAZR Trader – Technical Analysis + Zacks Rank. Best of both worlds approach to find timely trades.

Follow Jared A Levyon twitter at @jaredalevy

Like Jared A Levy onFacebook

Fox – Treasury yields decline as stocks continue to slide