This stock might not be as much of a gamble as you think. International Gaming technology (IGT) is a Zacks Rank #2 and trades at just over 12 times forward earnings. The company has beaten the Zacks Consensus Estimates two earnings reports in a row (5 of the last 6), exceeding analysts’ expectations by an average of 17.4%.

Company Description

IGT can trace its roots all the way back to the 1950s, but since going public in 1981 the company has reinvented itself, expanded and is now one of the largest manufacturers of computerized casino gaming products and operators of proprietary gaming systems in the world. It was the first to develop computerized video gaming machines and has made a recent foray into online gaming.

IGT is also a member of the S&P 500 and is headquartered in Nevada with offices in Reno and Las Vegas.

A Changing Landscape

IGT is in the midst of a proxy battle for board seats as the company looks to broaden its horizon and maybe alter its trajectory.

While traditional games (slots) is still paying the bills for IGT, the next generation of gamblers (and the company) may lie online and in social media. Current management has begun to take the company in the online direction through mergers and acquisitions.

Baby-boomers are the #1 target audience for companies like IGT, but they are gambling less and on the decline as the biggest segment of gamblers in the U.S. Younger, more tech savvy individuals are spending more money and time at casinos, but they are less willing to sit at a slot machine for 4 hours. They are also spending quite a lot of time online, wagering billions of dollars annually.

IGT spent as much as $500 million last year for Double Down Interactive, a maker of casino-like games for Facebook.com. It paid about $115 million in 2011 for Entraction Holdings AB, a European online gambling business (IGT shut down the online poker business of Entraction only a year after the acquisition, they intend to redistribute the talent and technology from the deal)

These acquisitions cost big money, but management believes that they are necessary to IGT’s relevance and success in the future of this changing industry.

But some shareholders don’t agree with this thesis and believe that IGT should stick to their core and grow their business organically.

Regardless of what side you’re on, IGT is making money and will need to innovate to keep up.

Shares are down about 30 percent from an October 2009 high under CEP Patti Hart, compared with a 37 percent increase for the S&P 500 Index over that time. IGT is no doubt at an inflection point, but they do have a strong core business and I believe that management is going in the right direction by researching and developing new, online and social media based operations. Even if it means spending money on acquisitions.

I also believe that online poker and gambling should and will return in a big way to the states, perhaps with the caveat that servers have to be located in the U.S.(in specific states) and certain taxes and fees be collected from those operators and/or participants.

The U.S. can use all the revenue we can get! Gaming industry experts estimate that something like 10 million to 15 million U.S. gamblers wager $4 billion to $6 billion online annually; why should states shun that potential revenue?

To me the logic is there, but logic is often hard to come by in Washington and politics in general.

The 2012 IGT annual meeting will be held on March 5th and should be interesting to watch. IGT remains on the right side of earnings growth trends.

Earnings and Revenue

The company primarily conducts its business through three segments: Gaming operations, Product Sales and Interactive. The company derived 76% of its 2012 revenue from domestic operations (U.S. and Canada), while the remaining 24.0% came from international markets. IGT earned revenues of $2.15 billion in fiscal 2012.

International gaming Technologies has been on a stable growth trajectory for 5 months, with the exception of a miss in the second quarter of 2012. The company posted a 64.71% rise in Q4 income compared to the same quarter a year prior and an almost 20% increase in sales in that same period.

Analysts have been moving estimates higher over the last 90 days for IGT’s results in the coming quarters and fiscal year. Shares have been catching up to the increased estimates, but the stock has lagged behind these bullish estimates. In fact, shares are about flat over the last year while earnings have increased. IGT’s trailing multiple is also 15% lower than last year.

Their industry is ranked 72 out of 265 and IGT is expected to earn 30 cents per share when they report earnings on April 23rd. Estimates are for IGT to earn $1.26 in FY 2013 and $1.32 in FY 2014.

The Charts

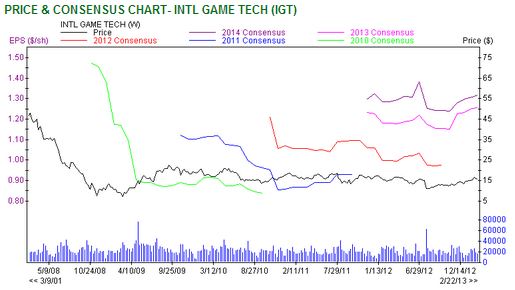

The price and consensus chart shows shares below the range of the “normal” relationship the shared with consensus estimates over the last 3 years. The correction in the estimates for 2012 created an equally nasty correction in the stock price (in the second chart below), but the current 2013 and 2014 estimates are increasing and generously above where estimates usually are in relation to IGT shares.

Shares are beginning to follow this trend, but should have some upside from here if the bullish earnings trend remains intact.

IGT remains in a strong bullish channel and is near the lower area of that range, indicating an advantageous entry point.

Support comes $15.44 and $15.25, which are the lower channel boundary and the 50 day VWAP average. The 50 day moving average recently crossed above the 200 day moving average, which is another positive sign for the longer term bulls.

Jared A Levy is one of the most highly sought after traders in the world and a former member of three major stock exchanges. That is why you will frequently see him appear on Fox Business, CNBC and Bloomberg providing his timely insights to other investors. He has written and published two tomes, “Your Options Handbook” and “The Bloomberg Visual Guide to Options”. You can discover more of his insights and recommendations through his two portfolio recommendation services:

Zacks Whisper Trader– Learn to buy stocks likely to have robust earnings BEFORE they report.

Zacks TAZR Trader – Technical Analysis + Zacks Rank. Best of both worlds approach to find timely trades.

Follow Jared A Levy on twitter at @jaredalevy

Like Jared A Levy on Facebook

Fox – Treasury yields decline as stocks continue to slide