By Jared A Levy

Options jargon can easily drive people nuts, whether they are novice or seasoned. Some names for certain strategies are certainly more intuitive than others. I’d like to think that the “Married Put” term is in the quasi-intuitive category. Regardless, I am going to spend the next dozen or so paragraphs addressing not only the definition, reasoning, and risk of the strategy, but also to address some of the questions we received during Tuesday’s Two Traders, One Strategy webinar. I encourage all of you to join us for this presentation every Tuesday at 4:30 p.m. Eastern Time. You can register here; it’s free.

Married Put Defined

The married put is just that; it’s a long put married to (combined with) long stock. It is a strategy that can be used to set a “stop limit” or to hedge your long stock position to the downside. For every 100 shares of stock a trader is long in her account, she would purchase one put to create the married put strategy. Off the bat, this may seem a bit strange; buying stock (a typically bullish act) but simultaneously buying a put (a bearish act)? The popular covered call strategy has a similar dichotomy (long stock, short call), but let me explain why the married put is quite different.

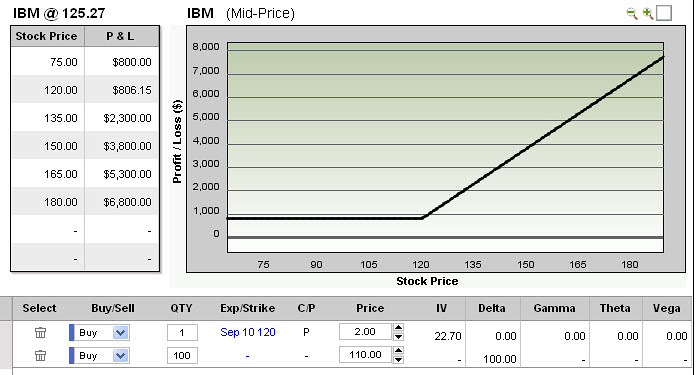

If you examine the risk graph above, you’ll notice that it looks completely different from the covered call. The married put strategy still offers unlimited upside potential, indicated by the 45-degree angle at the right half of the graph, above the breakeven point. On the left half of the chart, below the breakeven point, you will notice the line is flat, meaning that downside is limited. So in theory, this is a limited downside strategy, with unlimited upside; that sounds great, doesn’t it?