by Jared Levy on July 8, 2010

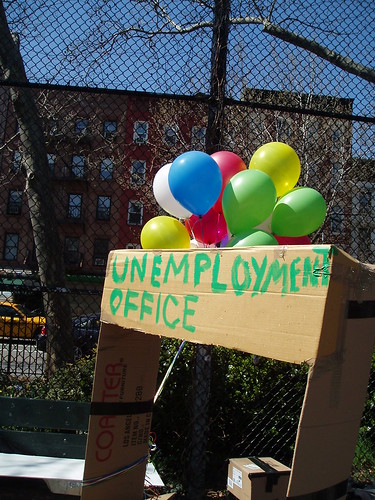

One of my favorite things to do is observe and sometimes laugh as market pundits (and sometimes that includes me) attempt to explain the reasons why the market does what it does. I woke up Thursday morning to S&P futures again moving higher by seven points and 10-year note yields above 3%. Lo and behold, the same folks who were calling for near-Armageddon last week now seem to think all is good in the world. The headlines read, “Unemployment Claims Drop More Than Expected … Market Looking Strong.” But is it … really?

One of my favorite things to do is observe and sometimes laugh as market pundits (and sometimes that includes me) attempt to explain the reasons why the market does what it does. I woke up Thursday morning to S&P futures again moving higher by seven points and 10-year note yields above 3%. Lo and behold, the same folks who were calling for near-Armageddon last week now seem to think all is good in the world. The headlines read, “Unemployment Claims Drop More Than Expected … Market Looking Strong.” But is it … really?

The S&P was up 31 points Wednesday and is up roughly 60 points from its recent low of 1010 just a couple of days ago. When the the S&P was trading at those lows, the index was below the two standard deviation daily Bollinger band, an oscillator that many analysts and traders use to pinpoint overbought or oversold conditions, (in this situation, the reading was obviously indicative of an oversold condition).

Supposedly, the big catalyst yesterday morning was that first-time unemployment claims for benefits dropped 21,000 in the past week to 454,000, when analysts were expecting a more narrow pullback to roughly 458,000. First off, the weekly numbers tend to be extremely volatile and generally don’t tend to get a ton of attention because of their unpredictable nature and their high tendency for revisions. Aside from all that, this number is not great and is just a tad below what analysts were expecting; it certainly doesn’t strike me as earth shattering.