If you like the online discount retailers that sell just about everything, but don’t like the price, multiple or slowing growth of a stock like Amazon ( AMZN – Analyst Report ) (a Zacks Rank #3, who reporting in-line earnings yesterday), then Overstock.com OSTK with a Zacks Rank of 1 and four earnings beats in a row might be worth a look.

Like Amazon, Overstock sells a plethora of products from electronics and jewelry to furniture and handmade items from global artisans; they even sell cars (I personally like their doomsday prepper section).

While they don’t sell music or have an app store or tablet like some of their competitors; their pricing, product selection and customer service are top notch and the company has been delivering solid earnings growth; sometimes the K.I.S.S. method works best.

Earning Checkup

One of the great things about this time of year is that we get the ability to take a detailed peak into how companies are functioning and performing. It’s like having your car recently inspected by a savvy mechanic, giving you a little more piece of mind as you drive.

On April 18th, Overstock.com reported Q1 results that beat the Zacks Consensus Estimates by a whopping 138.5%. Total net revenue for Q1 2013 and 2012 was $312.0 million and $262.4 million, respectively, a 19% increase. They attributed the growth in net revenue primarily to a 21% increase in average order size, partially offset by a small decrease in the number of customer orders.

On the gross profit side, they saw a 24% year over year increase to $58.9 million, representing 18.9% and 18.1% of total net revenue for those respective periods. The increase in gross profit was primarily due to higher revenue and a shift in product sales mix into higher margin home and garden products, and lower warehousing costs, profits were partially offset by higher freight costs.

Gross margins also increased 80 basis points to 18.9% from the same quarter in 2012.

I also liked that free cash flow was on the rise, it totaled$32.3 millionand$3.5 millionfor the twelve months endedMarch 31, 2013and 2012, respectively. The$28.8 millionincrease was due to a$36.1 millionincrease in operating cash flows, partially offset by a$7.2 millionincrease in capital expenditures.

It was a fantastic quarter that was applauded by investors, who took the share price from $11.00 just ahead of the report, to its current level of $20.70, a nearly 90% jump in price. Overstock obviously passed this checkup with flying colors!

When we explore technicals, I’ll give you an idea of where you can find support and targets for the stock.

When you look at some of Overstock’s peers, their 22.8 forward P/E multiple seems rather cheap. Overstock, like Amazon allows buyers to find the best prices from multiple suppliers and gives consumers very low relative prices on many of their products.

A recent Nielsen State of the Media Consumer Usage Report placed Overstock.com among the top five most visited mass merchandiser websites. The NRF Foundation/American Express Customer Choice Awards ranks Overstock.com #4 in customer service among all U.S. retailers which helps when your prices are at parity with your competitors.

Their Club O program is similar to Amazon Prime, but way more attractive and highly used among their customer base. It offers free shipping, rewards and discounts on select products.

Overstock doesn’t have the infrastructure or overhead that Amazon ( AMZN – Analyst Report ) does per se, which can be viewed as good and bad. Frankly, I think its better that they are more technology focused as opposed to being a mass distributor and having the huge overhead like Amazon does.

With their 2011 O.co URL acquisition, the company is beginning to push its international and mobile expansion and adjust their image as an “overstock only” company. They have gone from being an online liquidator to a diverse retailer with a multitude of channels in which to sell product.

Their industry is ranked 30 out of 265 and is rated as a strong buy here at Zacks and an average buy among other analysts.

I like to think of it as buying Amazon a couple years back while they were in their strongest growth phase and for a fraction of the 190 times P/E multiple that Amazon is trading at now.

The Charts

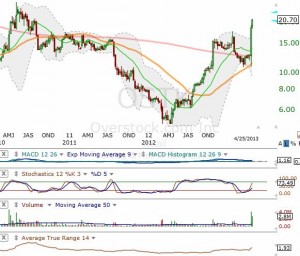

The charts are the tricky part here because shares have recently undergone a major rally. A signal of strength is that there has been a 5 day follow-through after the initial 60% pop in the stock, even through the turbulent market days last week.

Shares are overbought at this point in time, but I wouldn’t expect too much of a correction (relative to what we just saw). Look for strong support around the $17.25 level, which is the bottom of the gap and the pre-earnings high for the shares.

Overstock has momentum on its side and everything above current levels is really uncharted territory unless you go back to 2010, when the stock hit a high of $26.50.

Prior to the earnings report volatility jump, it was typical for OSTK to move about 60 cents or 5% a day, so shares were never that tame. During a week’s time, the stock will typically oscillate about $1.50, so I would use that as our short term retracement level from current prices.

I think shares down at the $18.00 mark would be a fair price to pay. To the upside, I wouldn’t be surprised if OSTK made a run for that 2010 high of $26.50, at which point I would be a seller.

The wildcard here is the broad market; even though OSTK has a Beta of only 0.84, its recent rally has the attention of short sellers looking for higher valuations.

If I were them, I would be looking to short Amazon, not Overstock.

I think this stock has some legs on it after a small retracement.

Jared A Levy is one of the most highly sought after traders in the world and a former member of three major stock exchanges. That is why you will frequently see him appear on Fox Business, CNBC and Bloomberg providing his timely insights to other investors. He has written and published two tomes, “Your Options Handbook” and “The Bloomberg Visual Guide to Options”. You can discover more of his insights and recommendations through his two portfolio recommendation services:

Zacks Whisper Trader– Learn to buy stocks likely to have robust earnings BEFORE they report.

Zacks TAZR Trader – Technical Analysis + Zacks Rank. Best of both worlds approach to find timely trades.

Follow Jared A Levyon twitter at @jaredalevy

Like Jared A Levy on Facebook

Fox – Treasury yields decline as stocks continue to slide