All too often, traders will move their capital into a sector that’s hot, only to watch the stock they select lose value; other times we see perfectly good companies losing share value because their peers or sector are falling out of favor.

PennyMac Mortgage Investment Trust is a real estate investment trust. The Company operates as a specialty finance company that will invest primarily in residential mortgage loans and mortgage-related assets. A substantial portion of the mortgages they acquire may be distressed and acquired at discounts to their unpaid principal balances.

Their 10%+ dividend makes them very attractive and since the housing market is flourishing, they should be a raging buy, right?

While the housing sector has been booming, the one-two punch from PMT is the fact that PennyMac buys distressed debt from FDIC liquidations of failed banks, US Treasury Legacy Loans Program auctions, and direct acquisitions from mortgage and insurance companies and foreign banks.

If less and less banks and loans are stressed or defaulting in this improving economy, then theoretically they have fewer loans to buy and profit from.

Second, a rising interest rate environment is not favorable for a company like PennyMac. Even though the Fed is a ways off from actually tightening, even a change in monthly bond purchases could quickly send mortgage rates higher (they are up over a 1% in the last 70 days or so) and stifle growth in housing.

A Silver Lining?

Even though shares of PMT have dropped almost 25% from a high of over $29.00 in February, to their current value of just under $22.00, there might still be high risks here.

Shareholders and their attorneys are investigating CEO Stanford L. Kurland on claims of self-dealing after certain statements that were made in an IPO statement back in February of this year when PennyMac Financial Services filed a Registration Statement to be spun off by PMT.

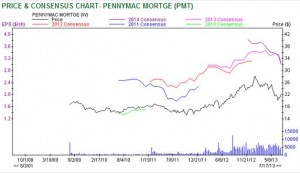

A look at the Zacks Price & Consensus chart shows a sharp, negative trajectory in FY2013 and 2014 earnings estimates. This drop is commiserate with the drop in share price and while the forward P/E of 7 and dividend yield of over 10% seem very attractive, there could be some more pain before this situation improves.

Perhaps this company has been beaten down a little too much here, but I would wait to see what the earnings report shows on August 1st before jumping in. There are way too many moving parts to this story and the fact that analysts have gotten this aggressive leads me to believe there is really fire behind all the smoke.

If you want to buy a mortgage related stock with a little less volatility and risk, check out JP Morgan-Chase (JPM – Analyst Report) (Zacks Rank #2) or America’s largest mortgage servicer, Wells Fargo WFC (Zacks Rank #2).

Jared A Levy is one of the most highly sought after traders in the world and a former member of three major stock exchanges. That is why you will frequently see him appear on Fox Business, CNBC and Bloomberg providing his timely insights to other investors. He has written and published two tomes, “Your Options Handbook” and “The Bloomberg Visual Guide to Options”. You can discover more of his insights and recommendations through his two portfolio recommendation services:

Zacks Whisper Trader– Learn to buy stocks likely to have robust earnings BEFORE they report.

Zacks TAZR Trader – Technical Analysis + Zacks Rank. Best of both worlds approach to find timely trades.

Follow Jared A Levy on twitter at @jaredalevy

Like Jared A Levy on Facebook

Fox – Treasury yields decline as stocks continue to slide